This part of the system documentation deals with all menu items on the MCM main menu tab Registers.

It makes frequent references to other parts of the full MCM documentation.

This topic includes the following sections:

Asset classes and asset class strategies form an important part in MCM in that they are used for

a variety of purposes and allow for organising and grouping of information.

MCM comes with default asset classes and asset class strategies that only serve as examples.

The user can create unlimited numbers of asset classes and asset class strategies.

The following provides an overview of where and how asset classes and asset class strategies are used in MCM.

One Asset Class can have many (unlimited) Asset Class Strategies

- Portfolios require the allocation of an asset class strategy.

- Investment guidelines that are created in the Master Guideline Register are allocated to

asset class strategies.

- MCM limit table templates - used for a portfolio’s authorised investment limits - are allocated to

asset class strategies.

- Reports always show an asset class, the strategies of the asset class and then for example the

portfolios or investment guidelines.

To differentiate asset classes used to administer portfolios from more than one country, provide a

country suffix/prefix such as Australian Fixed Interest or US Fixed Interest.

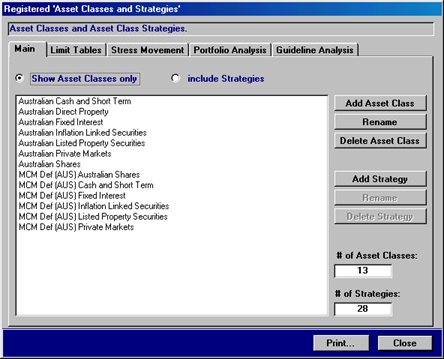

When first opened, the Registered ‘Asset Classes and Strategies’ form appears as shown below. Initially, only the Asset Classes are shown.

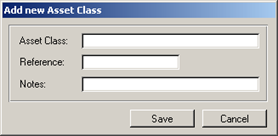

To add a new asset class, press the button Add Asset Class. The following form will appear.

Simply enter the description of the asset class and press the button Save. The reference

and notes fields are optional

To rename an existing asset class, select the record in the above shown register and press the button

Rename.

The same small form as shown above will appear with the current asset class description. Rename

the asset class and press the button Save.

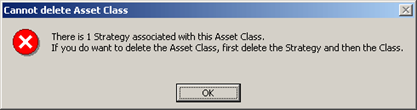

To delete an asset class, select the record in the register and press the button Delete Asset

Class. If the asset class has strategies allocated, MCM will not delete the record and instead

provide a message that informs the user that the strategies need deleting first. The message is shown

below.

If no strategies are allocated to the asset class that will be deleted, MCM requires confirmation prior

to deleting the asset class.

To be able to use asset classes and strategies throughout MCM, an asset class must have at least 1

strategy.

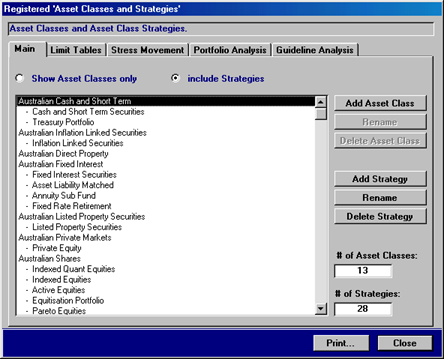

To show all asset classes and asset class strategies, press the option button include Strategies on the register. The register with all strategies is shown below.

The list box shown includes several strategies for most asset classes.

To add a new asset class strategy, select the asset class to which the strategy will be

allocated to and then press the button Add Strategy. The form that will appear is shown on

the next page.

To rename an existing asset class strategy, select the asset class strategy record and

then press the button Rename (located below the button Add Strategy). The

form that will appear is identical to the one when adding a new strategy. The form is shown on the next

page.

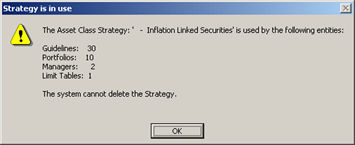

To delete a strategy, select a strategy record and press the button Delete Strategy. If it

is used, a message that includes where the strategy is used in MCM will appear as shown on the left.

The strategy details form that appears when creating a new strategy or renaming an existing strategy

is shown below.

The section Stress Testing and Warning Range are currently not utilised in MCM.

The MCM Stress Testing during the consolidation process is based on values provided on a security level and the warning range is in most cases 10%.

Simply provide the strategy name (when creating a new record) or rename the existing strategy. When

completed, press the button Save.

The fields Strategy alias and Notes are optional.

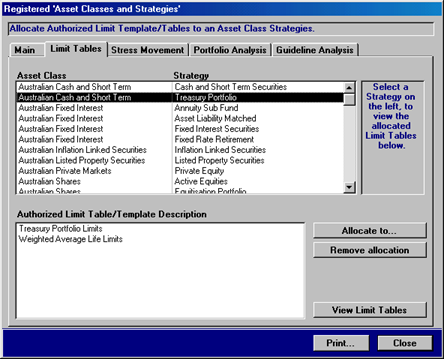

The Limit Tables tab of the Registered ‘Asset Classes and Strategies’

form is shown below and it is designed to allocate MCM Limit Table Templates to asset

class strategies.

Once an MCM Limit Table Template is allocated to an asset class strategy,

portfolios of that strategy will have the corresponding Limit page on the Portfolio

Details form available.

To find out more about the Limit pages of the Portfolio Details form, view

the manual Portfolios chapter Portfolio Details – The Limit Pages, or click

here.

The Portfolio Details form is the only form that uses the MCM Limit Table Templates!

Select a record in the top list box to view the allocated MCM Limit Table Templates in the lower list box.

To add an MCM Limit Table Template to an asset class strategy, select the strategy record in the top

list box shown on the previous page and then press the button Allocate to…. This will open

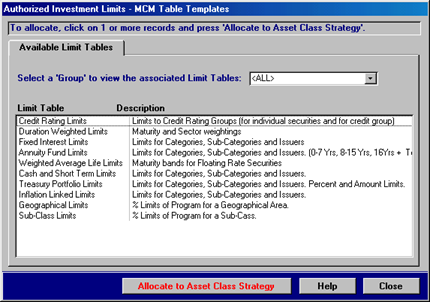

the Authorised Investment Limits – MCM Table Templates form as shown below.

Select a grouping from the drop-down menu to view commonly allocated limit table templates.

The above shown Available Limit Tables page of the Authorised Investment Limits

– MCM Table Templates form displays all available templates. To allocate a template to the

selected asset class strategy, press the button Allocate to Asset Class Strategy. The form

allows the selection of multiple records.

To remove an MCM Limit Table Template from an asset class strategy, select the asset

class strategy to view the allocated templates and then select the template that is to be removed. Press

the button Remove allocation on the Available Limit Tables page of the

Registered ‘Asset Classes and Strategies’ form.

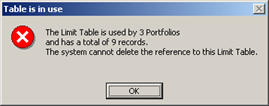

Prior to removing the reference to the selected asset class strategy, MCM will verify if portfolios

make use of the table template. If it is used, a message with the number of records in the portfolio limit

table template will appear as shown below.

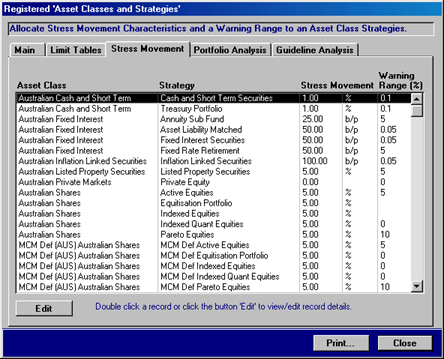

The Stress Movement page of the Registered ‘Asset Classes and

Strategies’ form is shown below and it is designed to provide an overview of the various the

stress values and warning ranges allocated to strategies.

To modify a value,

press the button Edit and the previously shown strategy details form will appear.

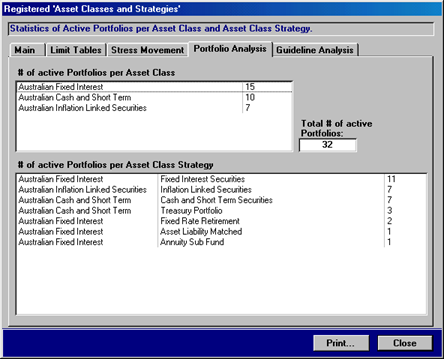

The Portfolio Analysis page of the Registered ‘Asset Classes and

Strategies’ form is shown below and it is designed to provide an overview of the number of active

portfolios allocated to the various strategies.

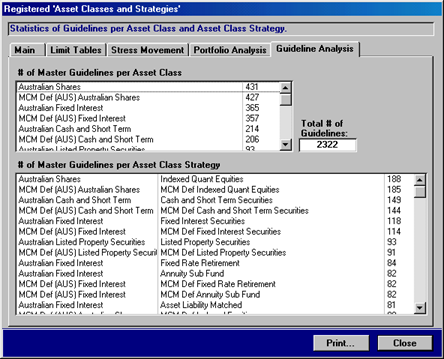

The Guideline Analysis page of the Registered ‘Asset Classes and

Strategies’ form is shown below and it is designed to provide an overview of the number of

investment guidelines allocated to the various strategies.

The investment guidelines refer to guidelines

from the Master Guideline Register.

The Master Guideline Register is designed to create, organize and store investment

guidelines that can then be allocated to portfolios. Investment guidelines are allocated to Asset

Class Strategies in order to provide the ability to organize different sets of investment guidelines

applicable to an overall Asset Class.

Portfolios source their investment guidelines from the Master Guideline Register.

The Master Guideline Register can be used to create and store the text of an entire

investment mandate that then can be allocated to a portfolio. This means that the register may hold many

records that are not monitored for example. The register allows creating paragraphs with bullet

points that represent guidelines and rules. Alternatively, the register may be used to only create

investment guidelines that are monitored.

Guideline algorithms can only be changed via the Master Guideline

Register. Once guidelines are posted to portfolios, only variables can be altered on the portfolio level!

The register has two overall record classifications that are Objectives and

Guidelines. Each of which can have many (unlimited) numbers of bullet-point records - the

rules. Unless otherwise stated, the term Guideline refers to a record in the Master

Guideline Register. This can be an objective or rule record or a guideline or rule record.

In addition to the overall two classifications, records can also be of type internal and

external. This allows for the creation of guidelines that are monitored for internal

purposes only. External records are guidelines that are part of the official investment

mandate.

A third classification is designed to provide a visual as well as programmatic indicator in terms of

how MCM treads each record. The following is an overview of this third classification.

| Classification |

Description |

| Monitored |

Records of this type require underlying algorithms and are monitored during the compliance monitoring process. |

| Sign-off required (Manager) |

Records of this type indicate that MCM cannot monitor the guideline and instead a sign-off is required from the Manager. |

| Sign-off required (Dealer) |

Records of this type indicate that MCM cannot monitor the guideline and instead a sign-off is required from the Dealer. |

| Sign-off required (Both) |

Records of this type indicate that MCM cannot monitor the guideline and instead a sign-off is required from both the Manager and Dealer. |

| Text only (not monitored) |

Records of this type indicate that the record is only a heading or introductory text. The record is not monitored. |

| Not Monitored |

Records of this type indicate that the record is not monitored. This is the default setting for Objectives |

| Included in the above |

This setting is used when a Guideline has several Rules and the algorithms for one Rule actually solves or covers an additional rule. In this case the setting for the Rule who"s algorithms are covered by the previous Rule is set to included in the above. |

The following are the in-built MCM rules in regard to the above mentioned classifications.

- Changing the internal or external classification of a guideline record will

automatically change all rules of the guideline record to the same setting.

- Changing the Guideline or Objective classification of a guideline record

will automatically change all rules of the guideline record to the same setting.

- Only guideline records with the classification Monitored can have underlying algorithms.

- Only guideline records with the classification Monitored are monitored by MCM.

- Changing the classification Monitored to another classification will delete the underlying algorithms.

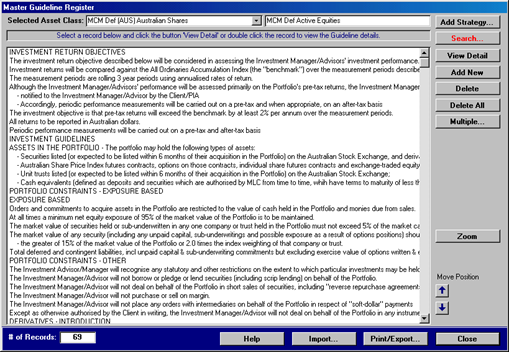

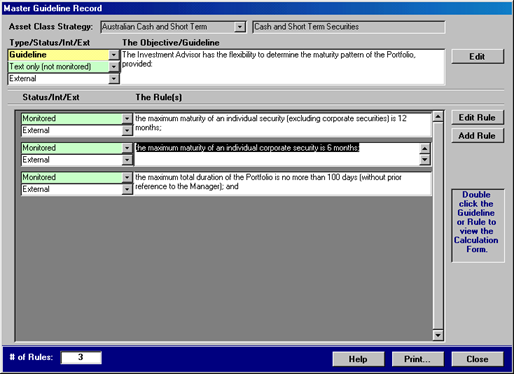

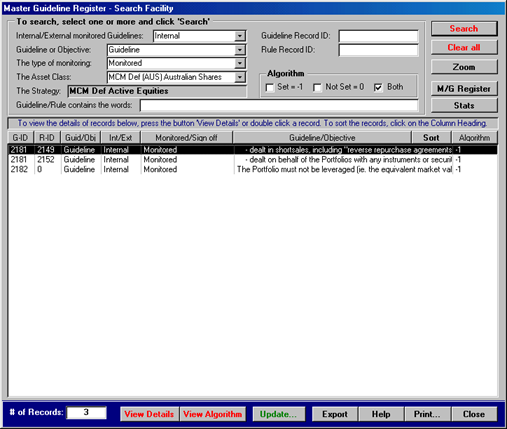

When first opened, the Master Guideline Register requires the selection of an asset class

strategy before records are displayed. In the example below, the default MCM Australian

Shares asset class and the default MCM Active Shares asset class strategy is

selected.

Select the Asset Class and Strategy to display the different sets

of investment guidelines.

Double-click a record to view the guideline details.

The following is an overview of the functions provided by the buttons on the right-hand side of the

above shown register.

| Add Strategy… |

Press this button to open the Asset Class and Strategies register. |

| Search… |

Press this button to open the Master Guideline Search Facility. |

| View Detail |

Press this button to view the guideline details of the selected record. |

| Add New |

Press this button to add a new guideline record to the selected asset class strategy. |

| Delete |

Press this button to delete a guideline record from the selected asset class strategy. |

| Delete All |

Press this button to delete all guidelines from the selected asset class strategy. |

| Multiple |

Press this button to select multiple records. This may be applicable when copying records to a portfolio or when copying records from one strategy to another. Once pressed, additional buttons will appear. |

| Zoom |

Press this button to view the selected record in a separate window in a larger font. |

| Move Position (2) |

Select a guideline or rule record and press the up or down arrow buttons to shift the position of the record. A rule record is moved within the rules and a guideline record is moved together with all rules. |

| Help |

Press this button to get help. |

| Import… |

This option is not available yet. |

| Print/Export… |

Press this button to print or export the guidelines. |

To view the details of a guideline, select a guideline or rule record from the Master Guideline

Search Facility and double-click the record or press the button View Detail. The

following screen will appear.

The Guideline record with the three classifications is at the top

A guideline can have many Rule records, they are shown below

If a record is of type Monitored, double-click to view the algorithms.

The internal or external setting is driven by the guideline record and cannot be changed for a rule record.

Press the button Edit in the objective/guideline section to modify the record. The

caption of the button will change to Save and a further Cancel button will

appear. Once complete, press the button Save to save the record, or cancel to discard any

changes.

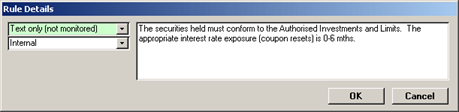

Press the button Edit Rule to edit the rule record. This will open a separate small form

as shown below.

Press the button Add Rule to add a new rule to the guideline record. A new record is

automatically created and shown in a separate small form. The form is shown below.

Enter the guideline text and select the appropriate classification from the green highlighted drop-

down menu. When complete, press the button OK.

The guideline algorithms are discussed below.

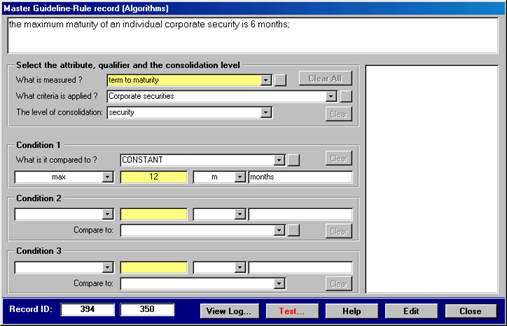

The Guideline Algorithms are designed to interpret a guideline’s text. The interpretation

is achieved via drop-down menus and does not require mathematical equations or similar. An example of

the guideline algorithms is shown below.

The yellow variable fields in the condition sections are the only items that can be changed once a guideline is posted to a portfolio!

The small square buttons next to the drop-down menus provides tips for the selected item.

The above shown form is made up of 4 sections and two large text boxes. The text box at the top

displays the guideline/rule record’s text and the text box on the right provides the test result when

testing a guideline or it displays tips/hints when selecting items from the various drop-down menus. The

four sections are explained below.

This section consists of three drop-down list boxes that determine what is measured, what filter or

criteria should be applied to the data and the level at which the data is consolidated. In addition, this

section contains two disabled buttons, the Clear All and Clear buttons. Both

buttons are enabled when the form is in editing mode.

The settings of the first section described in the above paragraph are compared and measured

against the settings in the Condition 1 section. There are three drop-down list boxes, the first determines

what the first section is compared to, the second is the operator and the unit. The yellow highlighted text

field is for a variable and the section also includes a Clear button.

Both of these sections are similar to the Condition 1 section and are there to allow for more complex

interpretations of the Guideline text, if applicable.

The contents of the various drop-down menus provide a vast number of combinations to solve a guideline.

The combinations are too numerous to list here.

MCM comes with over 135 pre-set guidelines that include the correct algorithms.

To view the guidelines, select the MCM default asset class strategies and then view the details of the guidelines.

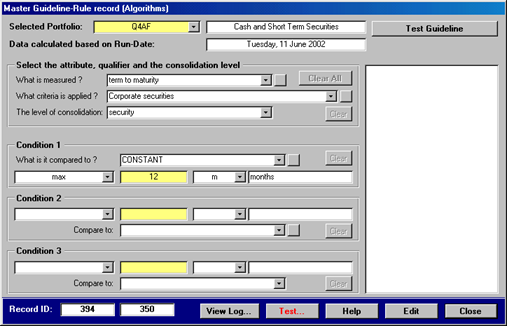

A master guideline record that is monitored can be tested on an existing portfolio’s underlying data.

For the test to work MCM needs at least one active portfolio with all relevant custodian data imported, translated and consolidated.

To test the algorithms of a guideline, press the button Test… on the above shown form.

This hides the text box at the top of the form and displays a drop-down menu from which a portfolio can

be selected. In addition, the date of the last imported data is displayed together with a button that

executes the test. Select the portfolio and then press the button Test Guideline.

Once the guideline was evaluated/tested, the result is displayed in the right-hand text box.

The Master Guideline Register allows the copying of guidelines from one asset class

strategy to another. This can be initiated by pressing the button Multiple… which will

display additional buttons and allow for the selection of multiple records.

To copy guidelines to another strategy, follow the below listed steps.

- Select the asset class strategy from which to copy the guidelines.

- Press the button Multiple…

- Select one or more guideline records.

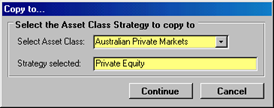

- Press the button Copy to and the following form will appear

Select the asset class strategy to copy the guideline to and then

- Press the button Continue

- The button caption Copy to on the register has changed now to Paste

- Press the button Paste

MCM confirms that the records were pasted and then selects the asset class strategy to which the

records were pasted.

All buttons revert to their previous state.

To copy the algorithms from one guideline to another, view the chapter Master Guideline

Search Facility.

The Master Guideline Search Facility is designed to provide a means of searching the

Master Guideline Register. The search facility is shown below. When first opened, no records

are shown in the large list box.

Search Fields

Select an item from the search fields.

Sorting

Click the column headings to sort the records.

View Details

Zoom into the investment guideline or the algorithms of the guideline.

Export/Print

Export the search results to MS Excel or print preview the results as a report.

Double-click a record in the list box to open the Guideline Details.

The following fields can be used for searching investment guidelines.

| Search Field |

Description |

| Internal/External |

Retrieves internal or external guidelines allocated to portfolios. |

| Guidelines/Objectives |

Retrieves Guideline or Objective records only. |

| Type of monitoring |

Retrieves investment guidelines based on the record type. |

| Client Portfolio |

A list of all registered active portfolios. Retrieves all guidelines allocated to a portfolio. |

| Asset Class Strategy |

A list of all registered asset-class strategies. Retrieves all guidelines allocated to portfolios of the selected strategy. |

| Master Guideline Rec/ID |

Retrieves investment guidelines based on Master Guideline record ID. |

| Guideline contains the words |

Retrieves investment guidelines based on the text within the guideline. |

To search, press the button Search. To clear the search fields, press the button

Clear all.

Once a search has produced one or more records it is possible to zoom into the following three

forms:

- The Guideline Details form - press the button Guideline Details

- The Algorithm Details form - press the button Algorithms

Each of the above mentioned forms was discussed in the previous chapter.

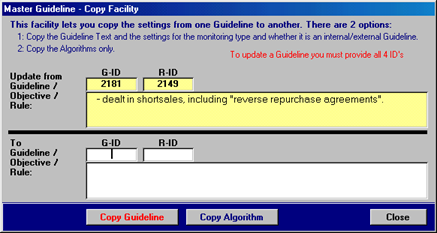

In addition to searching, the Master Guideline Search Facility can also be used to copy

the algorithms and other settings from one guideline to another. This done via the Copy

Facility that provides a further quick way to manage new or change existing Guideline

records.

To use the Copy Facility, click the button Update... and the form shown

below will appear.

The Copy Facility requires the Guideline and Rule record ID of the Guideline to copy from

and the ID of the Guideline you want to update.

Entering the record ID into the two fields will automatically retrieve the guideline text.

There are two options available and they are:

- Copy the basic settings of a guideline record. These include the

actual guideline text, the internal/external setting, the guideline/objective classification and the type

monitoring classification. To use this option, make sure all 4 record IDs are entered and then press the

button Copy Guideline.

- Copy the algorithms only. To use this option, make sure all 4 record IDs are

entered and then press the button Copy Algorithm.

The four record IDs are required to update a guideline.

The top section of the form shown above contains the Guideline record that is used to update the

guideline shown in the lower section.

Another way to locate record IDs...

- Select the guideline via the search facility and then press the button Update….

- This will automatically enter the required ID for the first guideline.

�

- Locate the target guideline record you want to update via the Search Facility and note down the record ID.

- Then locate and select the Guideline record you want to use to update the first Guideline.

The Debt Issuer Register is applicable to debt securities only and the primary purpose

of the register is to create structures that are used for the allocation of real issuers. In addition the

register also allows the creation of special structures that contain credit rating bands and

other non-issuer records.

Records from the Debt Issuer Register can be allocated to

the following Portfolio Limit Table Templates:

- Annuity Limits

- Cash Limits

- CPI Limits

- Credit Rating Limits

- Fixed Interest Limits

- Treasury Limits

Similar to the Master Guideline Register, records from the Debt Issuer

Register are posted/allocated to portfolio limit table templates. To find out more about portfolio

limit table templates, view the documentation Portfolios chapter Portfolio Details – The Limit

Pages or click here.

Depending on requirements the register allows mixing the two purposes - real issuers/non-issuers.

The required records for the portfolio limit table template drives this need.

The Debt Issuer Register makes use of a three level record structure that allows

organising and grouping issuers and non-issuer records. Records are allocated to countries. The three

level record structures are as follows:

- Broad Category

- Sub-category

- Issuer

For evaluation and reporting purposes, each level contains record classifications that determine how

MCM interprets the data-subset. An overview of the classifications is provided below. In addition, each

classification is discussed in detail together with examples further below.

The following overall classifications are available for broad category records.

| Type |

Registered Category Classification |

Description |

| Issuer Category |

Federal Government |

These categories together with appropriate (user definable) sub-categories are used to allocate real issuers to. Non-issuer records can also be allocated to these categories. |

| State Government |

| Banks |

| Corporate Debt & other non-short term securities |

| Security Type |

Mortgage/Asset backed |

These categories together with special sub-categories and non-issuer records are used for evaluation purposes only. Real issuers are not allocated to these categories. |

| Short-term Securities |

| Cash & Cash Equivalents |

| Futures and Options |

| Fixed Rate and Swaps |

| Other |

Credit Rating Band |

Special category type, issuers are not allocated to this category. |

The following overall classifications are available for sub-category records.

| Registered Sub-Category Classification |

Description |

| Default |

The default record type can be used for any meaningful user-defined sub-category description. |

| Major Trading Banks |

Use this sub-category classification together with an Issuer Category to allocate real issuers to. If used with a Security Type Category it must exist with an Issuer Category too. |

| Tax Advantaged Securities |

Can be used in either Issuer or Security Type Categories |

| Details (not evaluated) |

Use this record type if no specific sub-category is required |

| Per Sub-Category |

Special sub-category type – is discussed below. |

| Per Issue |

Special sub-category type – is discussed below. |

| Per Issuer |

Special sub-category type – is discussed below. |

The following overall classifications are available for issuer records.

| Registered Issuer Classification |

Description |

| Default |

The default record type is used for real issuers. |

| Per Issuer |

Special issuer type – discussed below. |

| Per Group (Credit Rating Band) |

Credit Rating Band record type – is discussed below. |

| Per Individual (Credit Rating Band) |

Credit Rating Band record type – is discussed below. |

Examples of different category/sub-category combinations and how they are evaluated are provided

further below.

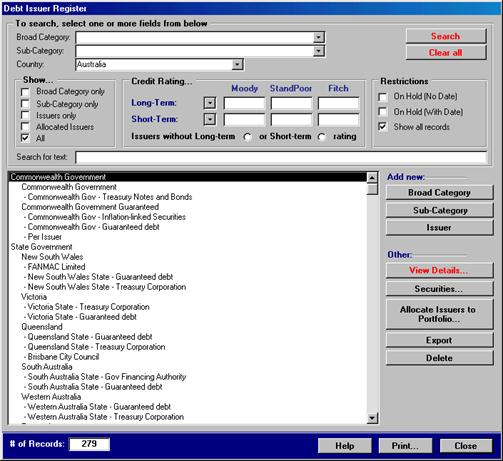

When first opened the Debt Issuer Register does not display any records. To

immediately display the records of the default country, press the button Search. The register

is shown below.

To search for records, use the available fields at the top and then press Search. To clear the fields, press Clear all.

To add new records, select the appropriate country and then use any of the 3 buttons.

To view details, select a record and press the button View Details or double-click the record.

To view securities allocated to issuers, click the button Securities….

To allocate records to portfolio limit table templates, press the button Allocate….

The above shown Debt Issuer Register form consists of the search area at the top, the

list box containing the records and several buttons to the right of the list box.

To export the displayed records, press the button Export. To delete a record, select the

record and then press the button Delete.

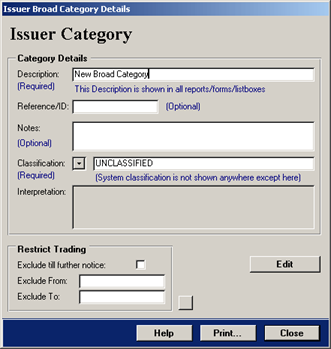

To add a new broad category record, simply press the button Broad Category in the

Add new: section. A new record will appear in the list box, the record is called New

Broad Category. To change the details, double-click the record or press the button View

Details. This will open the Issuer Broad Category Details form that is shown

below.

Only the description field is required.

To enter the new description, press the button Edit.

This will change the button caption to Save and the Cancel button will appear.

A new record always has the default UNCLASSIFIED MCM classification.

To change the MCM classification, select the proper classification from the drop-down menu.

To view the interpretation of the MCM classifications simply double-click the interpretation field.

To save the record, press the button Save.

To cancel any changes, press the button Cancel.

To return to the Debt Issuer Register press the button Close.

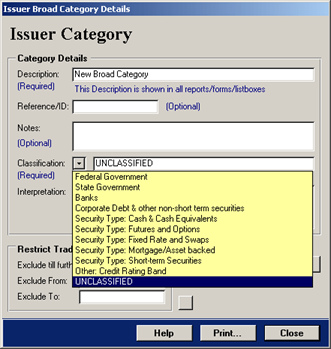

The MCM classifications in the drop-down menu are shown below.

The user description of the broad category record should closely match the MCM classification.

Restrict Trading

The Restrict Trading section allows restricting the trading for a given time period or till further notice.

MCM will flag a breach if a record was allocated to a portfolio limit table.

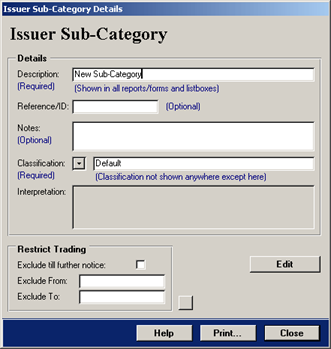

To add a new sub-category record, select a record within the broad category to which the sub-

category record will be added and press the button Sub-Category in the Add

new: section. A new record will appear in the list box, the record is called New Sub-

Category. To change the details, double-click the record or press the button View

Details. This will open the Issuer Sub-Category Details form that is shown

below.

To enter the new description, press the button Edit.

This will change the button caption to Save and the Cancel button will appear.

Only the description field is required.

A new record always has the Default MCM classification.

To change the MCM classification, select the classification from the drop-down menu.

To view the interpretation of the MCM classifications simply double-click the interpretation field.

To save the record, press the button Save.

To cancel any changes, press the button Cancel.

To return to the Debt Issuer Register press the button Close.

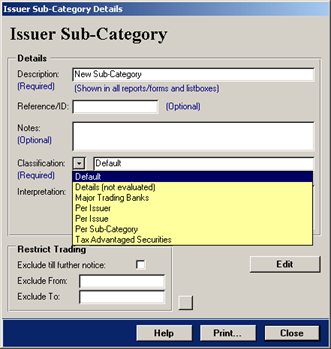

The MCM classifications in the drop-down menu are shown below.

For records of type Default classification, simply enter the desired sub-category description.

For classifications other then the Default classification, the user description should closely

match the MCM classification.

Restrict Trading

The Restrict Trading section allows restricting the trading for a given time period or till further notice.

MCM will flag a breach if a record was allocated to a portfolio limit table.

To add an issuer record, select a record within the broad category’s sub-category to which the record

will be added and press the button Issuer in the Add new: section.

This will show the Issuer Details form that is shown below.

An issuer record requires the allocation of a long-term and short-term credit rating.

Press the Edit button to modify the details of the record.

A new record always has the Default MCM classification.

This classification is appropriate for real issuers.

To change the MCM classification, select the classification from the drop-down menu.

To view the interpretation of the MCM classifications simply double-click the interpretation field.

Existing Records

To edit the credit ratings only of an existing record, press the Edit button in the top section.

To edit the issuer name, press the Edit button in the lower section.

New Records

For new records, press the Edit button in the lower section.

Issuer records can be created at two locations in MCM:

- In the Debt Issuer Register discussed here.

- On the Update page of the Securities w/o Issuer or Credit Ratings form.

This form can be accessed from the main menu section Maintenance.

For the second option to show the relevant broad categories and sub-categories, at least 1 issuer record must be allocated in

the Debt Issuer Register!

The MCM classifications in the drop-down menu are shown below.

To save the record, press the button Save.

To cancel any changes, press the button Cancel.

To return to the Debt Issuer Register press the button Close.

For records of type Default classification, simply enter the issuer name.

For classifications other then the Default classification, the user description should closely match the MCM classification.

Restrict Trading

The Restrict Trading section allows restricting the trading for a given time period or till further notice.

MCM will flag a breach if a record was allocated to a portfolio limit table.

Catch all issuer record

Only real issuer records are used to allocate securities to.

Create a catch-all issuer record to allocate all Cash securities to.

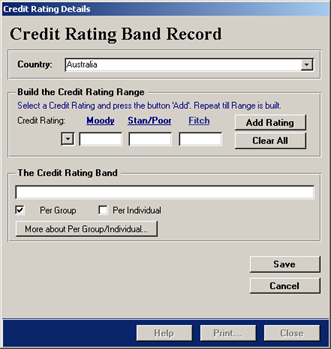

To create a credit rating band record, first add a new issuer record as described in the above chapter.

Once the lower Edit button is pressed, the Create Credit Rating Band check-

box appears. Simply tick the check-box and the Credit Rating Details page will appear as

shown below.

Creating a Credit Rating Band - The Steps

First select the Per Group or Per Individual check-box.

This determines whether individual securities (Per Individual) or securities that fall into the band (Per Group) will be evaluated.

Then select a credit rating from the drop-down menu and press the button Add Rating.

This will add the credit rating to the text box The Credit Rating Band.

Repeat till the band is completed and then press the button Save.

A completed credit rating band is shown below.

To return to the Debt Issuer Register press the button Close.

The following options are available when searching for records in the Debt Issuer Register.

| Broad Category |

Select an item and it will show the selected Broad Category and all associated Sub-Categories and Issuers. |

| Sub-Category |

Select an item and it will show the selected Sub-Categories and all Issuers. |

| Country |

Select a country and it will show all records for this country. |

| Broad Category only |

Select this to show all Broad Categories for the selected country. |

| Sub-Category only |

Select this to show all Sub- Categories for the selected country. |

| Issuers only |

Select this to show all Issuers for the selected country.

The list box will show the issuer name and both long-term and short-term credit ratings for the issuers.

NOTE selecting this option alters the default double-click behaviour. |

| Allocated Issuers |

Select this to show all Issuers - for the selected country – that have securities allocated.

The list box will show the issuer name and both long-term and short-term credit ratings for the issuers.

NOTE selecting this option alters the default double-click behaviour. |

| All |

Select this to show all records for the selected country. |

| Long-term |

Select a long-term credit rating and the search result will show all issuers with that long-term credit rating. |

| Short-term |

Select a short-term credit rating and the search result will show all issuers with that short-term credit rating. |

| Without long-term… |

Select this option to show all issuers that have no long-term credit ratings. |

| Or short-term rating |

Select this option to show all issuers that have no short-term credit ratings. |

| On Hold (no date) |

Select this option to view all records that have a trading restriction till further notice. |

| On Hold (with date) |

Select this option to view all records that have a trading restriction for a given period. |

| Show all records |

Select this option to view all records. |

To search for a text string, simply enter the text into the field.

To execute the search, press the button Search. To clear all search fields, press the button Clear all.

The following provides a detailed documentation of the MCM record classifications for:

- broad categories

- sub-categories

- issuer records

It includes examples and in-built rules that MCM follows when evaluating and reporting records that are allocated to portfolio limit table templates.

The documentation also explains how investment guidelines make use of and evaluate

securities allocated to issuers within broad categories.

The examples provided are illustrations for use in portfolio limit table templates.

The static limit values that are entered into these limit table templates

are not shown here but are implied when referring to how MCM evaluates these limits.

The following are terms and rules used by MCM when evaluating portfolio limit table templates.

| Term |

Description |

| Domain |

A domain is a data-subset that can span several broad categories.

Typical examples are all Security Type categories such as Security Type: Mortgage/Asset backed.

The domain will evaluate all securities of type mortgage backed no matter where the issuers are allocated. |

| Corporate Debt |

Referring to Corporate Debt means Corporate Debt and other non-short term securities.

This is a registered classification that is also a domain.

The domain Corporate Debt includes all issuers that are allocated to this broad category

PLUS all issuers allocated to the registered broad category Banks.

The domain does not include securities of type Short-term and Cash & Cash Equivalents. |

| Null Value |

Null value refers to portfolio limit table templates where a record does not have a static

limit allocated. If a null value is encountered, MCM skips the record. |

The following are the registered Broad Category classifications used by MCM.

Registered Broad Category: Federal Government

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- Add sub-categories to separate guaranteed debt and treasury notes.

- Create only one Federal Government category for a given country

(creating 2 or more works but the total of each category will be the same!)

- Evaluates a given limit for all issuers within this domain of a given country.

Portfolio Investment Guidelines evaluate the Federal Government Category for ALL countries - unless restricted by a currency user setting!

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| Commonwealth Government |

Fed Gov |

Total for category/domain |

| Treasury Notes and Bonds |

Default |

Total for sub-category |

| Commonwealth Government |

Default |

Total for issuer in sub-category |

| Government Guaranteed |

Default |

Total for sub-category |

| Com. Gov. Guaranteed debt |

Default |

Total for issuer in sub-category |

| Com. Gov. Inflation-linked |

Default |

Total for issuer in sub-category |

Registered Broad Category: State Governments

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- Add sub-categories to separate states, guaranteed debt and treasury notes.

- Create only one State Government category for a given country

(creating 2 or more works but the total of each category will be the same!)

- Evaluates a given limit for all issuers within this domain of a given country.

Portfolio Investment Guidelines evaluate the State Government Category for ALL countries - unless restricted by a currency user setting!

Example

| User record description |

MCM classification |

Evaluation |

| State Government |

State Gov |

Total for category/domain |

| New South Wales |

Default |

Total for sub-category |

| NSW State - Guaranteed debt |

Default |

Total for issuer in sub-category |

| Victoria |

Default |

Total for sub-category |

| VIC Treasury Corporation |

Default |

Total for issuer in sub-category |

| VIC Guaranteed debt |

Default |

Total for issuer in sub-category |

| South Australia |

Default |

Total for sub-category |

| SA Gov Financing Authority

|

Default

|

Total for issuer in sub-category

|

| SA Guaranteed debt |

Default |

Total for issuer in sub-category |

Registered Broad Category: Banks

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- Add sub-categories to separate licensed, subsidiaries of overseas banks and others.

- Create only one Banks category for a given country

(creating 2 or more works but the total of each category will be the same!)

- Evaluates a given limit for all issuers within this domain of a given country.

Portfolio Investment Guidelines evaluate the Banks Category for ALL countries - unless restricted by a currency user setting!

MCM classification MTB = Major Trading Banks (registered classification)

Catch-all issuer

The Bank Bills (catch all) is a registered classification record that can be used to allocate all bank bills and bonds.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| Licensed Banks |

Banks |

Total for category/domain |

| Major Trading Banks |

MTB |

Total for sub-category |

| ANZ Banking Group |

Default |

Total for issuer in sub-category |

| CBA |

Default |

Total for issuer in sub-category |

| NAB |

Default |

Total for issuer in sub-category |

| Westpac Banking Corporation |

Default |

Total for issuer in sub-category |

| Bank Bills (catch-all) |

Default |

Total for issuer in sub-category |

| Other Banks |

Default |

Total for sub-category |

| Banque Nationale de Paris |

Default |

Total for issuer in sub-category |

| ABN AMRO Australia Limited |

Default |

Total for issuer in sub-category |

| Subsidiaries of Overseas Banks |

Default |

Total for sub-category |

| UBS Australia Limited |

Default |

Total for issuer in sub-category |

| Chase Securities Limited |

Default |

Total for issuer in sub-category |

| Deposits with Building Societies |

Default |

Total for sub-category |

| XYZ Corporation |

Default |

Total for issuer in sub-category |

Registered Broad Category: Corporate Debt & other non-short term securities

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- Add sub-categories to separate specific corporate debt or others.

- Create only one Corporate Debt category for a given country

(creating 2 or more works but the total of each category will be the same!)

- Evaluates a given limit for all issuers within this domain of a given country.

Portfolio Investment Guidelines evaluate the Corporate Debt Category for ALL countries - unless restricted by a currency user setting!

This domain includes ALL registered broad categories for a given country with the exception of the Broad Categories: Federal and State Governments for this country.

In addition, the category will not report on any short-term securities that are allocated within this domain.

To evaluate short-term securities, see Broad Categories for Security Types.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Other Corporate Debt |

Default |

Total for sub-category |

| AMP Ltd |

Default |

Total for issuer in sub-category |

| Aurora |

Default |

Total for issuer in sub-category |

| Boral Ltd |

Default |

Total for issuer in sub-category |

| Specific Corporate Debt |

Default |

Total for sub-category |

| BHP Unsecured Bonds |

Default |

Total for issuer in sub-category |

| Telstra Inscribed Bonds |

Default |

Total for issuer in sub-category |

| Leases |

Default |

Total for sub-category |

| MEDFIN Leases |

Default |

Total for issuer in sub-category |

| Mortgage/Asset-backed security Issuers |

Default |

Total for sub-category |

| Air Train Citilink |

Default |

Total for issuer in sub-category |

| Crusade Auto Trust |

Default |

Total for issuer in sub-category |

| Duke Energy Australia |

Default |

Total for issuer in sub-category |

Registered Broad Category: Security Type: Cash & Cash Equivalents

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- If cash and cash equivalents are allocated to issuers in the broad category Banks

than there is not need to create issuers in this category.

- If this is not the case, create a sub-category (Details) and create a catch-all issuer record.

- Alternatively, create a sub-category (Details) and add real issuers and allocate the securities to those.

- Evaluates a given limit for securities of type Cash & Cash Equivalents in this domain of a given country.

MCM registered broad category classification STCCE = Security Type: Cash & Cash Equivalents

MCM registered Catch-all issuer record classification = Cash & Cash Equivalents (Catch-all) (used to allocate all Cash & Cash Equivalents securities)

Portfolio Investment Guidelines evaluate the Security Type: Cash & Cash Equivalents Category for ALL countries - unless restricted by a currency user setting!

Example

| User record description |

MCM classification |

Evaluation |

| Security Type: Cash & Cash Equivalents |

STCCE |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Cash & Cash Equivalents (Catch-all) |

Default |

Total for issuer in domain |

The above example is applicable to the Debt Issuer Register in order to allocate securities to the catch-all issuer record.

For portfolio limit table templates, the broad category record is sufficient to report the exposure of cash and cash equivalents!

The Security Type: Cash & Cash Equivalents category is an exception when it comes to

allocating issuers to security type categories.

An alternative is to create a catch-all issuer record within the Banks category or

allocate cash to real issuers within the Banks.

This means that the total for the Banks category always includes cash! In the above

example, the Banks category would not include cash!

Registered Broad Category: Security Type: Futures and Options

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- The Futures and Options category is a security type category and no issuers should be allocated to this category.

- create a catch-all issuer within the Banks category or allocate the futures and options to the appropriate issuer wherever they may be located.

- Add registered sub-categories such as Per Issuer or Per Issue or Credit Rating Bands for further evaluation purposes.

- Evaluates a given limit for securities of type Futures and Options in this domain of a given country.

Allocating the record to a portfolio limit table template will automatically report on the exposure of all futures and option on futures securities.

Portfolio Investment Guidelines evaluate the Security Type: Futures and Options Category for ALL countries - unless restricted by a currency user setting!

Example

| User record description |

MCM classification |

Evaluation |

| Security Type: Futures and Options on Futures |

STFOF |

Total for category/domain |

Registered Broad Category: Security Type: Fixed Rate and Swaps

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- The Fixed Rate and Swaps category is a security type category and no issuers should be allocated to this category.

- Create a catch-all issuer within the Banks category or allocate the Fixed Rate and Swaps to the appropriate issuer wherever they may be located.

- Add registered sub-categories such as Per Issuer or Per Issue or Credit Rating Bands for further evaluation purposes.

- Evaluates a given limit for securities of type Fixed Rate and Swaps in this domain of a given country.

Allocating the category record to a portfolio limit table template will automatically report on the

exposure of Fixed Rate and Swaps securities.

MCM Release 4.2 - Evaluation of Fixed Rate and Swaps is disabled!

Portfolio Investment Guidelines evaluate the Security Type: Fixed Rate and Swaps Category for ALL countries - unless restricted by a currency user setting!

Example

| User record description |

MCM classification |

Evaluation |

| Security Type: Fixed Rate and Swaps |

STFRS |

Total for category/domain |

Registered Broad Category: Security Type: Mortgage/Asset backed

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- The Mortgage/Asset backed category is a security type category and no issuers should be allocated to this category.

- Allocate the Mortgage/Asset backed securities to the appropriate issuer wherever they may be located.

- Add registered sub-categories such as Per Issuer or Per Issue or Credit Rating Bands for further evaluation purposes.

- Evaluates a given limit for securities of type Mortgage/Asset backed in this domain of a given country.

Allocating the above category record to a portfolio limit table template will automatically report on the

exposure of all Mortgage/Asset backed securities.

Portfolio Investment Guidelines evaluate the Security Type: Mortgage/Asset backed Category for ALL countries - unless restricted by a currency user setting!

Example

| User record description |

MCM classification |

Evaluation |

| Security Type: Mortgage/Asset Backed |

STMAB |

Total for category/domain |

Registered Broad Category: Security Type: Short-term Securities

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- The Short-term Securities category is a security type category and no issuers should be allocated to this category.

- Allocate Short-term Securities to the appropriate issuer wherever they may be located.

- Add registered sub-categories such as Per Issuer or Per Issue or Credit Rating Bands for further evaluation purposes.

- Evaluates a given limit for securities of type Short-term Securities in this domain of a given country.

Allocating the above category record to a portfolio limit table template will automatically report on the

exposure of all Short Term Securities.

Portfolio Investment Guidelines evaluate the Security Type: Short-term Securities Category for ALL countries - unless restricted by a currency user setting!

Example

| User record description |

MCM classification |

Evaluation |

| Security Type: Short Term Securities |

STSTS |

Total for category/domain |

Registered Broad Category: Other: Credit Rating Band

Applies to Debt Securities that are used by Authorised Investment Limit Tables within Portfolios.

Overview

- The category Credit Rating Band requires the sub-category (Details) and one or more credit rating band records.

- Allocating this category record to a limit table will evaluate the entire domain for a given country.

The MCM classification OCRB = Other: Credit Rating Band.

The difference in the example below is that the Other: Credit Rating Band category indicates to evaluate ALL securities

whereas the second category inspects the data-subset of Corporate Debt only!

MCM provides two Credit Rating evaluation options and they are:

- Portfolio Investment Guidelines - contains a limited number of credit rating evalution options (discussed in the Investment Guidelines Topic)

- Authorised Investment Limits (this section) - provides more options and greated flexibility

If the below structures are allocated to the Credit Rating limit table template none of the

category records are evaluated! Only the credit rating bands will be evaluated!

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| General Credit Ratings |

OCRB |

Not evaluated |

| Details |

Details |

Not evaluated |

| Per group: AAA, AA+, AA |

Per Group |

Total of all securities within band |

| Per group: AA-, A+, A |

Per Group |

Total of all securities within band |

| Per group: A-, BBB+ |

Per Group |

Total of all securities within band |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Per group: AAA, AA+, AA |

Per Group |

Total of all Corp Debt securities within band |

| Per group: AA-, A+, A |

Per Group |

Total of all Corp Debt securities within band |

| Per group: A-, BBB+ |

Per Group |

Total of all Corp Debt securities within band |

Registered Broad Category: UNCLASSIFIED

This is not a valid Registered Broad Category! It is the default classification allocated to new records.

Requires changing to an appropriate classification.

The following are the registered Sub-Category classifications used by MCM.

Registered Sub-Category: Default

Overview

- The Default sub-category evaluates any user-defined description.

- Evaluates a given limit compared to the total of all issuers listed within this sub-category.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Specific Corporate Debt |

Default |

Total for sub-category |

| BHP Unsecured Bonds |

Default |

Total for issuer in sub-category |

| Telstra Inscribed Bonds |

Default |

Total for issuer in sub-category |

Registered Sub-Category: Details (not evaluated)

Overview

- The Details (not evaluated) sub-category is not evaluated and usually is used when no other sub-categories exist and issuers need to be registered/allocated.

- The sub-category can be used for registered credit rating band categories in order to allocate credit rating bands.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Per group: AAA, AA+, AA |

Per Group |

Total of all Corp Debt securities within band |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Details |

Details |

Not evaluated |

| BHP |

Default |

Total of issuer in domain |

Registered Sub-Category: Major Trading Banks

Overview

- The Major Trading Banks sub-category is a special sub-category that can be allocated twice.

- Allocate the sub-category to the category Banks in order to allocate real issuers.

- Allocate the sub-category again - for example - to a registered Security Type Category such as Security Type: Short Term Securities.

- In the first instance the total for the sub-category is evaluated.

- In the second instance the total for Major Trading Banks in relation to the Security Type is evaluated.

- Real issuers should only be allocated to the first instance (Category Banks).

Example

| User record description |

MCM classification |

Evaluation |

| Licensed Banks |

Banks |

Total for category/domain |

| Major Trading Banks |

MTB |

Total for sub-category |

| ANZ Banking Group |

Default |

Total for issuer in sub-category |

| Westpac Banking Corporation |

Default |

Total for issuer in sub-category |

| Security Type: Short Term Securities |

STSTS |

Total for category/domain |

| Major Trading Banks |

MTB |

Total for sub-category for the given security type |

Registered Sub-Category: Per Issuer

Overview

- The Per Issuer sub-category evaluates a given limit compared to the total of each Issuer within a given Category or Domain.

- It can be allocated to issuer category type categories as well as security type categories.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| Licensed Banks |

Banks |

Total for category/domain |

| Per Issuer |

Per Issuer |

Total per issuer |

| Security Type: Short Term Securities |

STSTS |

Total for category/domain |

| Per Issuer |

Per Issuer |

Total per issuer for the given security type |

Registered Sub-Category: Per Issue

Overview

- The Per Issue sub-category evaluates a given limit for each Security in a given Category or Domain.

- It can be allocated to issuer category type categories as well as security type categories.

Example

| User record description |

MCM classification |

Evaluation |

| Licensed Banks |

Banks |

Total for category/domain |

| Per Issue |

Per Issue |

Total per issue |

| Security Type: Short Term Securities |

STSTS |

Total for category/domain |

| Per Issue |

Per Issue |

Total per issue for the given security type |

Registered Sub-Category: Per Sub-Category

Overview

- The Per Sub-Category sub-category evaluates a given limit compared to the total of each Sub-Category within a given Category.

- Applies only if issuers are allocated to any of the sub-categories that are inspected.

- An example would be the broad category state governments that could have several sub-categories each representing a different state.

- Furthermore, adding static limits to the Per Sub-Category sub-category with evaluate the total for each state and flag if any state has breached this limit.

- Should only be allocated to issuer category types and not security category types.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| State Government |

State Gov |

Total for category/domain |

| New South Wales |

Default |

Total for sub-category |

| NSW State - Guaranteed debt |

Default |

Total for issuer in sub-category |

| Victoria |

Default |

Total for sub-category |

| VIC Treasury Corporation |

Default |

Total for issuer in sub-category |

| South Australia |

Default |

Total for sub-category |

| SA Gov Financing Authority |

Default |

Total for issuer in sub-category |

| Per State |

Per Sub Cat |

Evaluates the total of each state (sub-category) |

Registered Sub-Category: Tax Advantaged Securities

Overview

- The Tax Advantaged Securities sub-category evaluates a given limit for all securities that are tax advantaged within a given Category or Domain.

- It can be allocated to issuer category types as well as security category types.

Example

| User record description |

MCM classification |

Evaluation |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Tax Advantaged |

Tax A |

Total of all tax advantaged securities within domain |

| Security Type: Mortgage/Asset Backed |

STMAB |

Total for category/domain |

| Tax Advantaged |

Tax A |

Total of all tax advantaged securities within domain |

The following are the registered Issuer classifications used by MCM.

Registered Issuer Name: Default

Overview

- The Default issuer record can be used for real issuers such Citibank Limited or GE Capital Limited or catch-all baskets such as Bank Bill (Major Trading Banks).

- Limits allocated to Default issuer records evaluate the total of all securities allocated to the issuer within a given sub-category.

- If the sub-category is the registered Details (not evaluated) sub-category, then issuers are totalled for the category or domain.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| State Government |

State Gov |

Total for category/domain |

| New South Wales |

Default |

Total for sub-category |

| NSW State - Guaranteed debt |

Default |

Total for issuer within sub-category |

| Corporate debt and other non-short term securities |

State Gov |

Total for category/domain |

| Details |

Details |

Not evaluated |

| BHP |

Default |

Total for issuer within domain |

Registered Issuer Name: Per Issuer

Overview

- The Per Issuer issuer record is used to evaluate the total of each issuer within a given Sub-Category.

- The record should only be allocated to issuer category types and not security category types.

Example

| User record description |

MCM classification |

Evaluation |

| Corporate debt and other non-short term securities |

State Gov |

Total for category/domain |

| Specific Corporate Debt |

Details |

Not evaluated |

| Per Issuer |

Per Issuer |

Total per issuer in sub-category |

| BHP |

Default |

Total for issuer in sub-category |

Registered Issuer Name: Per Individual (Credit Rating Band)

Overview

- The Per Individual (Credit Rating Band) issuer record is used for credit rating bands that can contain a number of credit ratings that will be evaluated.

- The Per Individual denotes that individual securities are inspected.

- The location of the record will determine which securities are included.

- It can cover a sub-category only, the domain of a broad category (Issuer or Security Type) or all records.

- If the sub-category with the registered name Per Sub-Category is used, the total of ALL records for EACH Issuer in ALL Sub-Categories will be evaluated.

The settings apply for a given country. The Limit Table for Credit Ratings evaluates 2 items at the same time and both the Per

Individual and Per Group are evaluated in the same way in this table.

In the example below when used with the MCM category classification OCRB = Other: Credit Rating Band it will evaluate ALL securities

When used with in the category Corporate Debt it will only inspect the data-subset of Corporate Debt.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| General Credit Ratings |

OCRB |

Not evaluated |

| Details |

Details |

Not evaluated |

| Per individual: AAA |

Per Individual |

Each security within band |

| Per individual: AA-, A+, A |

Per Individual |

Each security within band |

| Per individual: AA+, AA |

Per Individual |

Each security within band |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Per individual: AAA |

Per Individual |

Each security within the Corp Debt domain |

| Per individual: AA-, A+, A |

Per Individual |

Each security within the Corp Debt domain |

| Per individual: AA+, AA |

Per Individual |

Each security within the Corp Debt domain |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Specific Corporate Debt |

Default |

Total of sub-category |

| Per individual: AAA |

Per Individual |

Each security within the sub-category |

| Per individual: AA-, A+, A |

Per Individual |

Each security within the sub-category |

| Per individual: AA+, AA |

Per Individual |

Each security within the sub-category |

| Security Type: Mortgage/Asset Backed |

STMAB |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Per individual: AAA |

Per Individual |

Each security within the domain |

| Per individual: AA-, A+, A |

Per Individual |

Each security within the domain |

| Per individual: AA+, AA |

Per Individual |

Each security within the domain |

| State Government |

State Gov |

Total for category/domain |

| Per State |

Per Sub Cat |

Evaluates the total of each state (sub-category) |

| Per individual: AAA |

Per Individual |

Per Issuer within domain |

| Per individual: AA-, A+, A |

Per Individual |

Per Issuer within domain |

| Per individual: AA+, AA |

Per Individual |

Per Issuer within domain |

Registered Issuer Name: Per Group (Credit Rating Band)

Overview

- The Per Group (Credit Rating Band) issuer record is used for credit rating bands that can contain a number of credit ratings that will be evaluated.

- The Per Group denotes that credit rating band/group is inspected/evaluated.

- The location of the record will determine which securities are included.

- It can cover a sub-category only, the domain of a broad category (Issuer of Security Type) or all records.

- In addition, if the sub-category with the registered name Per Sub-Category is used, the total of ALL records in ALL Sub-Categories will be evaluated.

All settings apply always for a given country.

The Limit Table for Credit Ratings evaluates 2 items at the same time. You can use both the Per Individual and Per Group in this table. Both are evaluated in the same way.

Example

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| General Credit Ratings |

OCRB |

Not evaluated |

| Details |

Details |

Not evaluated |

| Per Group: AAA |

Per Group |

All securities within band |

| Per Group: AA-, A+, A |

Per Group |

All securities within band |

| Per Group: AA+, AA |

Per Group |

All securities within band |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Per Group: AAA |

Per Group |

All securities within band in the Corp Debt domain |

| Per Group: AA-, A+, A |

Per Group |

All securities within band in the Corp Debt domain |

| Per Group: AA+, AA |

Per Group |

All securities within band in the Corp Debt domain |

| Corporate debt and other non-short term securities |

Corp Debt |

Total for category/domain |

| Specific Corporate Debt |

Default |

Total of sub-category |

| Per Group: AAA |

Per Group |

All securities within band in the sub-category |

| Per Group: AA-, A+, A |

Per Group |

All securities within band in the sub-category |

| Per Group: AA+, AA |

Per Group |

All securities within band in the sub-category |

| Security Type: Mortgage/Asset Backed |

STMAB |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Per Group: AAA |

Per Group |

All securities within band in the domain |

| Per Group: AA-, A+, A |

Per Group |

All securities within band in the domain |

| Per Group: AA+, AA |

Per Group |

All securities within band in the domain |

| State Government |

State Gov |

Total for category/domain |

| Per State |

Per Sub Cat |

Evaluates the total of each state (sub-category) |

| Per Group: AAA |

Per Group |

All securities within band in domain |

| Per Group: AA-, A+, A |

Per Group |

All securities within band in domain |

| Per Group: AA+, AA |

Per Group |

All securities within band in domain |

The following are examples that provide a work-around for more complex credit rating rules.

Example 1

- A category record includes a credit rating restriction and the securities must be less then twelve months.

- The Major Trading Banks sub-category requires the inspection per bank for the domain short-term securities including item 1 restrictions.

- The Other sub-category requires the inspection per issuer - other then those covered by item 2 - for the domain short-term securities including item 1 restrictions.

The Guideline/Rule

| Description |

Limit |

| Short Term Securities – term less then twelve months, rated A1 or higher by Standard and Poor’s |

100% total for category |

| Major Trading Banks |

25% per bank |

| Other |

5% per issuer |

MCM capabilities

| Key |

| Category |

| Sub-category |

| Issuer |

| User record description |

MCM classification |

Evaluation |

| Security Type: Short Term Securities |

STSTS |

Total for category/domain |

| Details |

Details |

Not evaluated |

| Per Group: A1+, A1 |

Per Group |

All securities within band in the domain |

| Major Trading Banks |

MTB |

Total for sub-category for the given security type |

| Per Issuer |

Per Issuer |

Total per issuer for the given security type |

Summary

The credit-rating band (per group) evaluates the category record for the item 1 (category).

The sub-category record Major Trading Banks evaluates only the total for the domain and not per bank!

The sub-category record Per Issuer evaluates all issuers (including the major trading banks) with no regard to credit ratings!

Example 2

A guideline/rule includes the following two restrictions:

- Debt guaranteed as opposed to treasury notes and bonds

- Not issued via central issuing authority

The correct issuers would need to be allocated to this sub-category AND

the securities allocated to those issuers would have to be of the above nature.

MCM capabilities

| User record description |

| State Government |

| Debt guaranteed by a State (but not issued via the CentralIssuing Authority) |

| - Per Group: AAA |

| - Per Group: AA-, A+, A |

Summary

View the examples provided in the chapter Broad Category Examples section State

Governments. Consider adding credit-rating bands within each state.

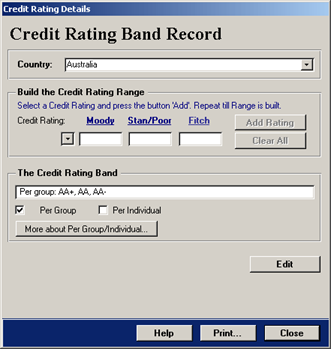

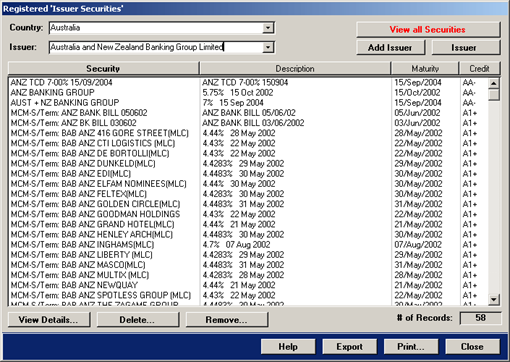

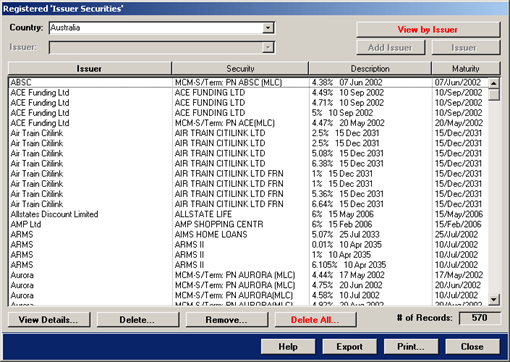

The Registered ‘Issuer specific Securities’ is a register that contains all debt securities.

Securities are added automatically to this register during the import/translation processes in the

event of new securities encountered.

When new securities are encountered they first appear in the Securities w/o Issuer and or Credit Ratings register.

After an issuer and a credit rating is allocated they become visible in the Issuer specific Securities register.

If the wrong issuer was allocated via the Securities w/o Issuer and or Credit Ratings facility, this register allows removing the reference to the issuer.

When opened from the main menu the register is blank and an issuer needs selecting.

The register is also called from other locations and it then may show the securities of a particular issuer.

The form is shown below.

Select the Country in the top and then select the Issuer

Press the button View all Securities to view all for the selected country

Add a new Issuer or view the Issuer details (double-click a record)

To sort the records in the list box, click on the column headings of the list box.

The above shown list box allows the selection of multiple records.

To remove the reference of securities to an issuer, select the record(s) and then press the button

Remove….

A confirmation is required prior to removing the reference.

The records will disappear from the Issuer specific Securities register and will now be in the Securities w/o Issuer

and or Credit Ratings register.

To delete issuer specific securities, select the records and then press the button Delete…

MCM requires a confirmation prior to deleting securities.

To view the details of a security, select the security record and press the button View

Details… or double-click the record. The details screen is shown on the next page.

To export or print the displayed records, press the button Export or Print....

The register stores unique securities only and a portfolio's securities may contain multiple records

of the same security. Editing the details of a security here has no effect on the securities in the portfolio

securities table with the exception of the credit rating and the issuer allocated!

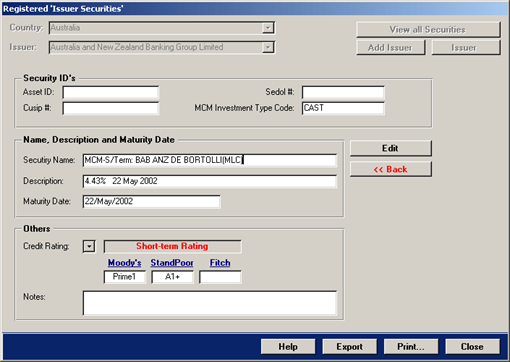

The details page of the Registered ‘Issuer specific Securities’ form is shown below.

To edit the record press the button Edit, to return to the previous screen press the button << Back.

The page showing all securities for a given country is shown below.

You can remove the reference to issuers for multiple records, simple select the records and then press the button Remove...

The View Details…, Delete… and Remove… buttons action as discussed above.

To delete all securities for the selected country, press the button Delete all… MCM requires confirmation prior to deleting all securities.

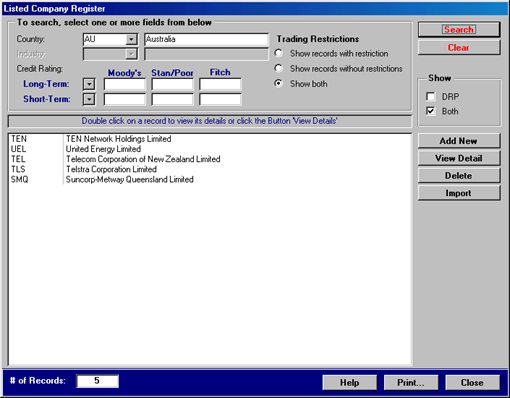

The Listed Companies register is used only in conjunction with the Contingent

Liabilities form that is discussed in the manual Portfolios. When opened, the register

does not display any records. To immediately display the records of the default country, press the button

Search. The register is shown below.

Select a country, credit rating or trading restriction and press the button Search.

To clear the search fields, press the button Clear.

To view the details of a listed company, select the record and press the button View Detail or double-click the record.

To delete a listed company, select the record and press the button Delete.

If the record is allocated to contingent liabilities, the record cannot be deleted.

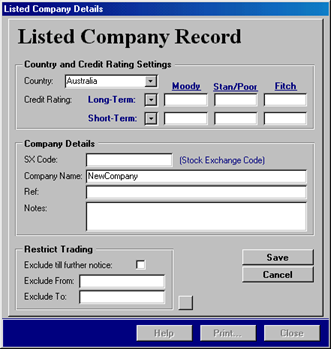

To add a new listed company, press the button Add New. The Listed Company

Details form will appear as shown below.

The provision of credit ratings is optional.

Enter the stock exchange code and the company name. The reference and notes fields are

optional.

The trading restrictions are not enforced for equity related securities.

To save the record, press the button Save.

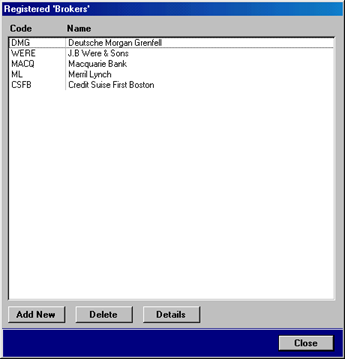

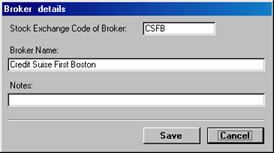

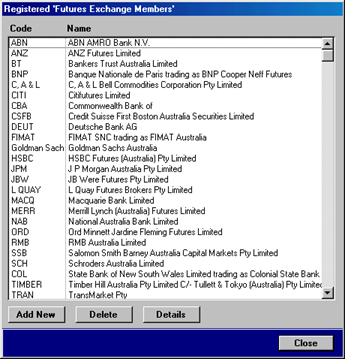

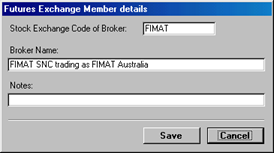

The Registered ‘Brokers’ form is shown below. Brokers are primarily used for the

Contingent Liabilities form that is discussed in the manual Portfolios.

To add a new broker, press the button Add New. A new record will be created and

displayed in the small form shown below.

To delete a broker, press the button Delete.

If the record is allocated to contingent liabilities, the record cannot be deleted.

To view the details of a record, press the button Details or double-click a record.

The following form will appear.

The stock exchange/reference code of the broker and the broker name is required.

The notes field is optional.

Press the button Save to save any changes, click the button Cancel to discard any changes and close the form.

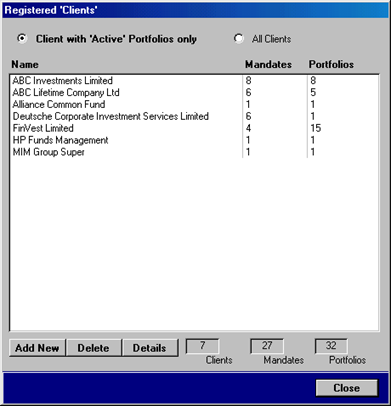

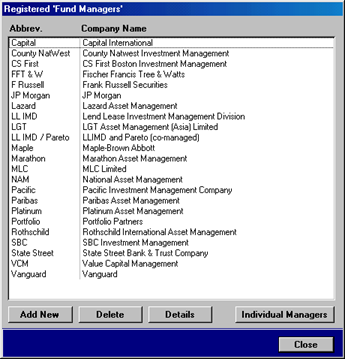

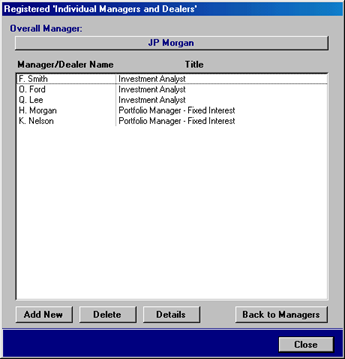

The Client Register provides an overview of registered clients and the number of

mandates and portfolios they have. The register is shown below.

When first opened, the register shows clients with active portfolios only.

To view all clients including in-active portfolios, click the option button All Clients.

The button is located at the top of the above shown form.

To add a new client, click the button Add New.

The will open the Client set-up Wizard that was discussed in the manual Portfolios in chapter Adding a new Client.

To delete a registered client, press the button Delete.

The client can not be deleted if one or more mandates exist.

To view the details of a client, select the client and then press the button Details or double-click the record.

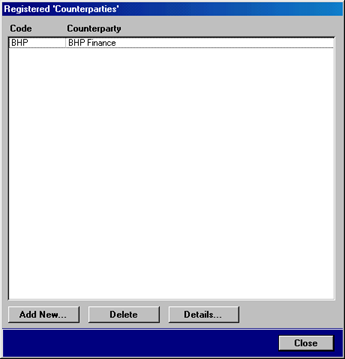

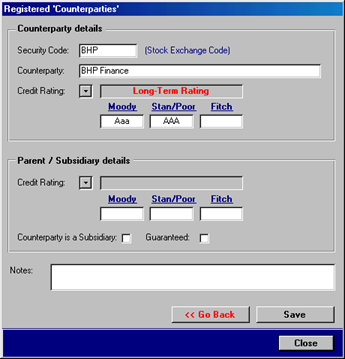

The Registered ‘Counterparties’ form is shown below.

Counterparties are allocated to the Client Details form that was discussed in the manual

Portfolios in chapter Client Details: Counterparties – Page.

To view the details of counterparties, select a record in the list box and press the button Details… or double-click the record.

To add new counterparties, press the button Add new… which will create a new record that is displayed in the below shown form.

To delete counterparties, select a record and press the button Delete.

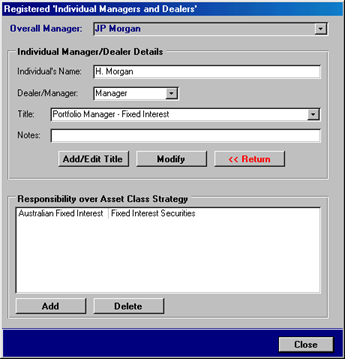

Counterparties can not be deleted if allocated to the Client Details form.